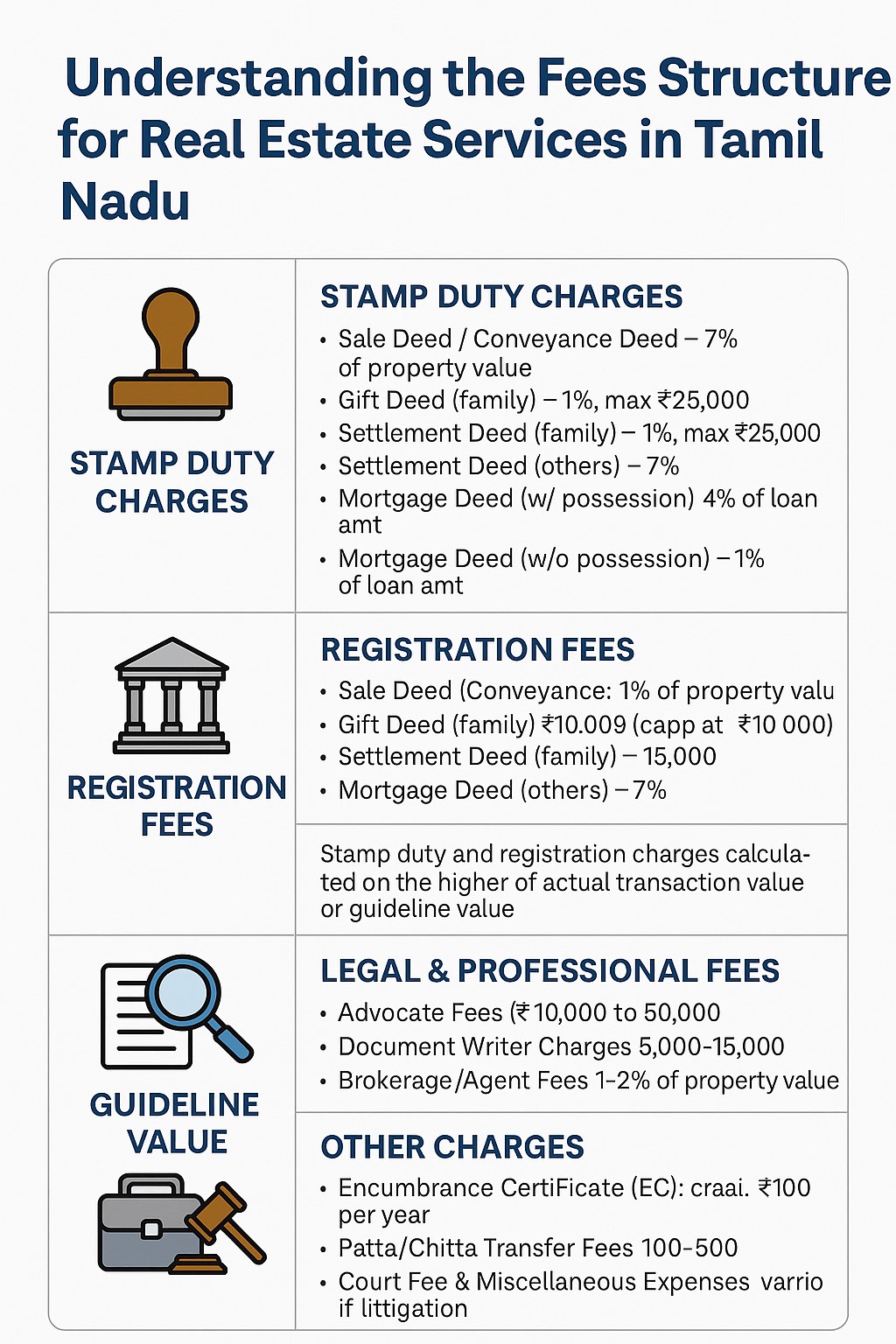

When buying, selling, or registering property in Tamil Nadu, it’s essential to understand the different fees and charges involved. From stamp duty to registration charges and professional service fees, each component adds to the overall cost of property transactions. Here’s a breakdown of the key fees applicable in Tamil Nadu.

1. Stamp Duty Charges

Stamp duty is a mandatory tax levied by the state government during property registration. In Tamil Nadu:

- Sale Deed / Conveyance Deed – 7% of the property’s market value

- Gift Deed (in favor of family members) – 1% of the property’s value (capped at ₹25,000)

- Settlement Deed (in family) – 1% of the property’s value (capped at ₹25,000)

- Settlement Deed (others) – 7% of property value

- Mortgage Deed (with possession) – 4% of loan amount

- Mortgage Deed (without possession) – 1% of loan amount

2. Registration Fees

Apart from stamp duty, a registration fee is payable at the Sub-Registrar’s office.

- Sale Deed / Conveyance – 1% of property value

- Gift Deed (family) – 1% of value (capped at ₹10,000)

- Settlement Deed (family) – 1% of value (capped at ₹10,000)

- Settlement Deed (others) – 1% of value

- Mortgage Deed – 1% of loan amount (capped at ₹2 lakhs)

3. Guideline Value

Tamil Nadu follows a guideline value system (decided by the Registration Department). The stamp duty and registration charges are calculated based on the higher of the actual transaction value or the guideline value.

👉 Homebuyers should always check the current guideline value of land/flat before proceeding with registration.

4. Legal & Professional Fees

In addition to government charges, there are professional fees associated with real estate transactions:

- Advocate Fees (for title verification, document scrutiny) – usually ₹10,000 to ₹50,000 depending on complexity.

- Document Writer Charges – typically ₹5,000 to ₹15,000.

- Brokerage/Agent Fees – commonly 1–2% of property value for resale, or a fixed fee for rentals.

- Architect/Surveyor Fees – in case of layout approval, boundary disputes, or property measurement.

5. Other Charges

- Encumbrance Certificate (EC) – around ₹100 per year of search.

- Patta/Chitta Transfer Fees – nominal, around ₹100–500.

- Court Fee & Miscellaneous Expenses – varies if litigation or extra verification is involved.

Final Thoughts

Understanding the fee structure in Tamil Nadu real estate helps buyers and sellers avoid surprises during property transactions. While stamp duty and registration fees form the largest portion of expenses, one must also budget for legal, documentation, and brokerage charges.

Being well-informed ensures a transparent and hassle-free property transaction.